Protect Your Online Store from Card Testing Attacks

Reading Time: 5 minutes

If you think running an online store is just about picking pretty products and posting cute photos, think again. There’s a dark, sneaky side of e-commerce lurking behind the scenes: card testing attacks. It’s the sneaky way hackers are trying to dip into your revenue without you even noticing.

But don’t worry: we’ve got your back! By the end of this post, you’ll know exactly what these attacks are, how to spot them, and, most importantly, how to kick them to the curb before they wreak havoc on your business.

What the Heck is a Card Testing Attack?

Imagine a hacker sitting at their computer with a bag of stolen credit card numbers, trying each one on your checkout page like it’s a candy machine. That’s basically a card testing attack.

These cybercriminals run automated scripts that “test” stolen cards on your website to see which ones are valid. They start with small purchases because if they go big and fail, it raises red flags. If the card works, they move on to bigger transactions or sell the verified information on the dark web. What’s worse? You might face chargeback fees, which typically vary anywhere between $5 and $100 per incident, depending on the circumstances.

It’s sneaky. It’s frustrating. And unfortunately, it’s more common than you might think. E-commerce stores, big or small, are prime targets.

Why Your Store is a Target

You might be thinking, “I’m just a small store, why would hackers care about me?” Well, here’s the truth: they don’t care who you are – they just want access.

Hackers use card testing attacks because your store is essentially a treasure chest of opportunity. Even small businesses have valid cards being tested daily. And the more automated their attacks, the less effort it takes for them to strike.

Plus, online stores often have less security than banks or massive retailers. So if your website has a checkout that’s easy to access, you’re on their radar.

Here’s another kicker: attackers love stores that don’t notice unusual transaction patterns. That means if you’re not monitoring daily activity closely, you could be handing over profits without realizing it. Ouch.

How to Spot Card Testing Attacks

Spotting card testing isn’t always obvious, but there are some telltale signs that scream, “Something’s up!”

- A spike in declined transactions – If your payment system suddenly looks like it’s getting rejected constantly, but the numbers don’t match your usual pattern, that’s suspicious.

- Unusually small purchases – Hackers often start small. Think $1, $2, or $5. If you see a bunch of tiny orders from new customers, keep your eyes open.

- High volume in a short time – A sudden surge in activity, especially from new accounts or unusual IP addresses, is a classic red flag.

- Random shipping addresses – Multiple orders shipping to different locations under the same card? Probably not a happy customer, probably a hacker testing the waters.

In short, if your checkout page suddenly starts feeling like Times Square on New Year’s Eve, it’s time to investigate.

Prevention Strategies

We know you want to protect your store. That’s why Raney Day Design offers care plans to manage spam, run security scans, launch daily site backups and more! You can learn more about our care plans online. Meantime, here are 7 more ways to keep those hackers out:

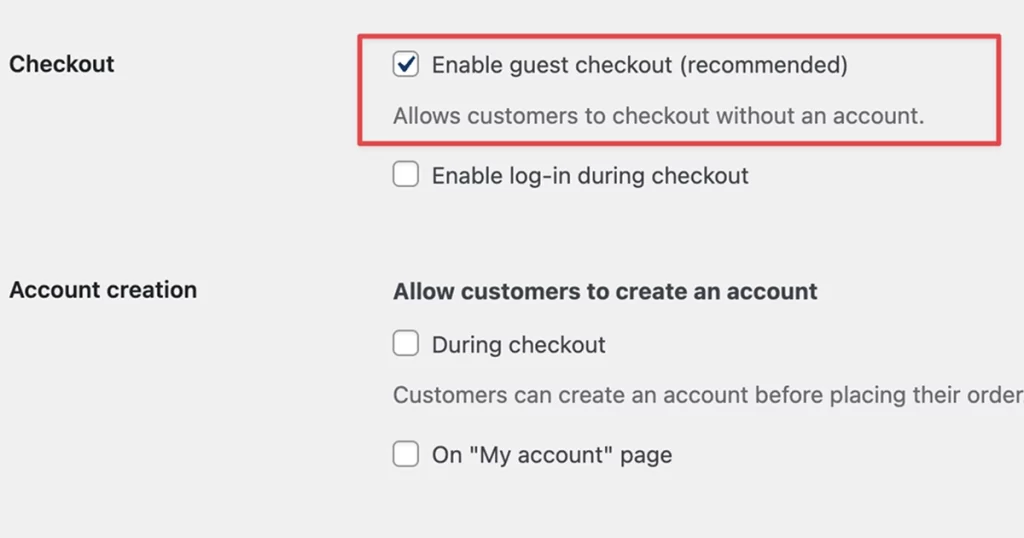

1. Disable Guest Checkout

Raney Day Design web developer Luc gives this tip straight up: turn off “guest checkout.” Even though WooCommerce lists it as “recommended,” it actually makes it super easy for scammers to run card testing attacks. By requiring customers to create an account, you add an extra layer of protection and make it a lot harder for hackers to test stolen cards without being noticed.

2. Lock It Down with CAPTCHA

CAPTCHAs aren’t just annoying puzzles – they’re like a velvet rope around your checkout. Only humans get in, bots stay out. And yes, even if it frustrates your coffee-fueled customers for a second, it’s worth it to keep your money safe.

3. Monitor IPs Like a Hawk

You don’t need to hire a private investigator. Just pay attention to where your traffic is coming from. If you see repeated attempts from the same IP or odd geographic locations, block them. Hackers hate being ignored.

4. Limit Failed Attempts

Don’t let hackers try card after card until they hit the jackpot. Set limits on how many failed transactions can occur per account or IP in a certain time frame. It’s like giving them a polite “no trespassing” sign.

5. Use Fraud Detection Tools

Plugins and payment gateways have come a long way. Many offer built-in fraud detection to flag suspicious behavior. For WooCommerce users, think about tools that monitor for unusual patterns, declining payments, and velocity checks (how quickly cards are being tried).

6. Keep Your Plugins and Payment Systems Updated

This might sound basic, but hackers love outdated software. Security patches are released for a reason, and ignoring them is basically leaving your door unlocked.

Pro Tip: Always back up your website before updating plugins. Update one at a time. Check for errors and issues before you continue.

7. Educate Your Team

Your employees are the first line of defense. Make sure everyone who handles orders or payments knows what to watch for. Sometimes spotting a hacker is as simple as someone noticing a weird pattern and saying, “Uh… this doesn’t look right.”

What to Do if You Get Hit

Even with all precautions, sometimes attacks happen. Don’t panic. Here’s a quick playbook:

- Block suspicious IPs immediately.

- Check for any successful fraudulent transactions and report them to your payment processor.

- Notify your bank and payment gateway so they can help mitigate losses.

- Investigate your site for vulnerabilities – are there plugins or outdated software that need updating?

- Communicate with your customers if their data may have been affected. Transparency builds trust.

Remember, the key is to act fast, stay calm, and treat your site like the fortress it’s meant to be.

Long-Term Tips & Best Practices

Card testing attacks aren’t a one-and-done deal – they’re an ongoing threat. Here’s how to stay ahead:

- Monitor daily activity: Make it a habit to check orders and transactions for unusual patterns.

- Update regularly: Plugins, themes, and WooCommerce updates aren’t optional – they’re your frontline defense.

- Use secure payment gateways: They offer additional layers of protection against fraud.

- Set up alerts: Many systems can notify you if there’s a spike in declined transactions or suspicious behavior.

- Educate customers: Encourage strong passwords, two-factor authentication, and awareness of phishing scams.

The best defense? Stay vigilant and proactive. Hackers might try to test your cards, but they’re not taking your profits. Not on your watch.

Running an online store is thrilling, but it comes with its share of cyber threats. Card testing attacks are sneaky, frustrating, and potentially costly, but with the right strategies in place, you can shut them down before they ruin your day.

Keep your checkout locked, monitor activity like a hawk, and don’t be afraid to get creative with security. Protect your profits, safeguard your customers, and show those hackers who’s boss.Raney Day Design is here to protect your site because at the end of the day, your online store deserves to shine – and hackers don’t get a VIP pass.